Market Overview & Quarterly Highlights

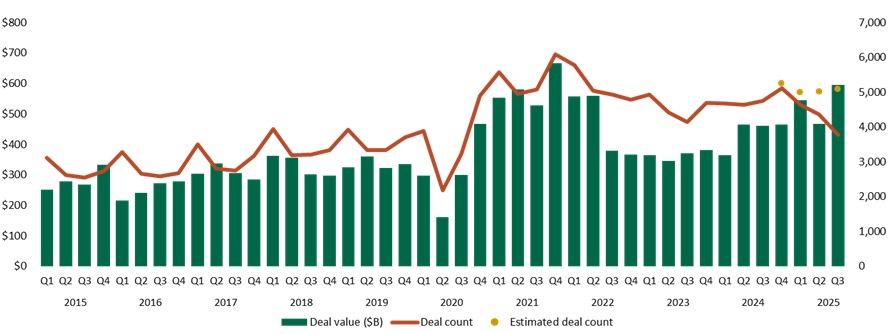

- Global PE market resilience: Q3 2025 reached $595B across 5,083 deals, one of the strongest quarters since 2021.

- Deal value: Jumped from $466.3B in Q2 to $595.3B in Q3 (+27.6%), an increase over the comparative period of 32%.

- Deal volume: Slight increase from 5,020 to 5,083 (+1.3%).

- Growth drivers: Surge of nearly $130B led by buyout and add-on deal rebounds, with volumes holding steady.

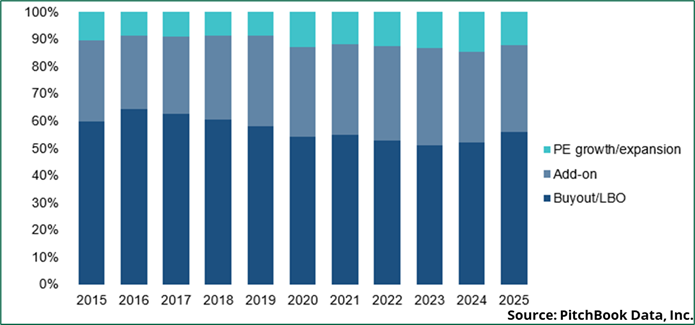

Deal Breakdown & Activity

- Buyouts/LBOs – $319.6B (+45%): Strong rebound from Q2; major deals in infrastructure, healthcare, and software.

- Add-ons – $149.9B (−12%): Slight slowdown; steady mid-market consolidation in Europe and North America.

Growth/Expansion – $52.2B (+31%): Recovery led by Asia-Pacific, driven by AI, renewables and fintech.

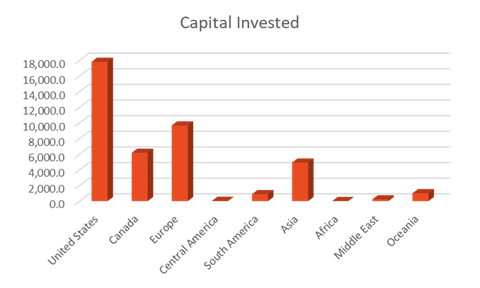

Impact Focused Geographic Trends – Q3 2025

- US – $17.8B | 169 deals: Leading in renewables and decarbonisation.

- Europe – $9.7B | 103 deals: Strong in climate tech and green infrastructure.

- Canada – $6.2B | 43 deals: Focus on clean power and ESG projects.

- Asia – $4.9B | 50 deals: Growth in AI, renewables, and sustainability.

- Oceania – $1.0B | 27 deals: Agri-tech and green hydrogen expansion.

- Middle East – $0.23B | 10 deals: Rising clean energy focus.

- Africa – $10M | 5 deals: Off-grid energy and microfinance.

- South America – $0.89B | 4 deals: Early renewable growth.

- Central America – $28M | 1 deal: Emerging climate projects.

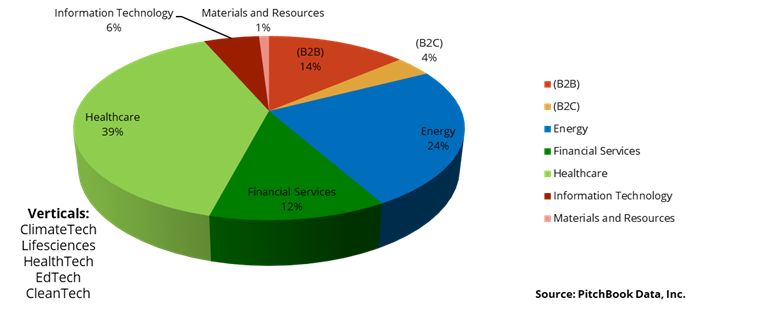

Impact Focused Sector Trends – Q3 2025

- Healthcare ($16.1B): Leading sector, driven by biotech, digital health, and longevity innovation.

- Energy ($9.9B): Strong momentum from renewables, grid storage, and decarbonisation projects.

- B2B ($5.6B): Growth in green supply chains, energy efficiency, and industrial tech.

- Financial Services ($5.0B): Expansion in ESG-linked financing and sustainable investment platforms.

- Information Technology ($2.2B): Focus on AI, data-driven climate solutions, and clean tech software.

- B2C ($1.5B): Rising demand for sustainable consumer and lifestyle brands.

- Materials & Resources ($0.4B): Targeted investment in recycling, low-carbon materials, and circular solutions.

Top 5 Global Impact Focused Deals

- Innergex Renewable Energy (Canada) – Acquired in a $7.47B management buyout (July 2025); long-term renewable leader since IPO in 2007.

- Duke Energy (United States) – Posted $7.51B revenue (+4.7% YoY) and $3.99B EBITDA; completed $1.75B debt refinancing (Sept 2025) for clean energy growth.

- EnBW Energie Baden-Württemberg (Germany) – Raised $3.62B via PIPE (July 2025) to expand renewable and electric mobility projects in Europe.

- HealthEdge (United States) – Acquired by Ardan Equity and Bain Capital through a $2.6B secondary buyout (Sept 2025), reinforcing digital healthcare growth.

- Huadian New Energy Group (China)– Secured $2.2B PIPE IPO (July 2025) at $18.2B valuation, continuing Asia’s clean energy surge.

Top 5 UK Impact-Focused Deals

Arden University (Coventry, England) – Online services acquired by Brightstar Capital in a $1B buyout (July 28, 2025), valuing the online education group at around $2B post-transaction.

Aukera UK (London, England) – Raised $122.7M in a PE Growth/Expansion round led by AtlasInvest and Reggeborgh Groep (Sept 15, 2025) to advance a 15 GW renewable energy pipeline across Europe.

Oxford BioMedica (Oxford, England) – Completed an $80.45M PIPE round (August 15, 2025) from undisclosed investors to expand U.S. commercial-scale operations in cell and gene therapy manufacturing.

Verici Dx (Cardiff, Wales) – Raised $8.62M through a PIPE (July 24, 2025), bringing total funding to $48.8M to scale its kidney disease diagnostics platform.

AFC Energy (Cranleigh, Surrey) – A clean energy pioneer that initially raised $6.01M at IPO (April 2007, LSE: AFC); continues to play a key role in the UK’s hydrogen power transition.

Key Takeaways and Outlook for Q4 2025

Q3 2025 stood out as one of the most confident quarters in recent years, with investors showing renewed discipline and focus amid a steadying macroeconomic backdrop.

- Deal values rose sharply, reflecting a return to larger, high-quality transactions driven by conviction rather than momentum.

- Mid-market resilience continued, supported by add-ons and growth capital targeting operational efficiency and sustainable innovation.

- Sustainability remained a key driver, with increasing capital flowing into renewable energy, green infrastructure and circular economy solutions.

- Impact and performance converged, as investors looked beyond returns to measurable outcomes in energy transition, resource efficiency and decarbonisation.

- Looking ahead: With stable credit conditions and strong dry powder, the market enters late 2025 with quiet confidence, prioritising quality assets that deliver both long-term financial value and positive environmental impact.