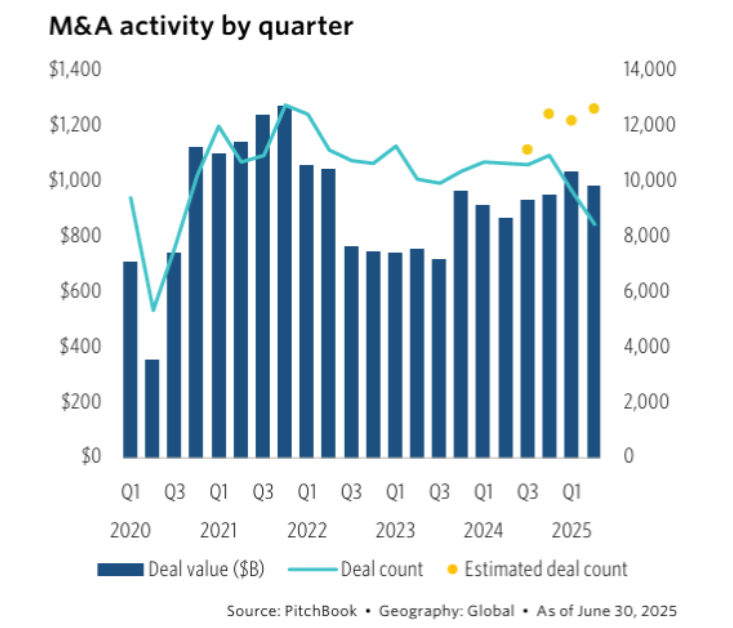

Global mergers and acquisitions (M&A) roared ahead in the first half of 2025, shrugging off economic and geopolitical headwinds. Dealmakers showed renewed confidence, driving $2.0 trillion in transactions across 24,793 deals – a year-on-year increase of 13.6% in value and 16.2% in deal count.

Q2: Momentum Holds Strong

The second quarter underscored this resilience, coming close to Q1’s record-breaking pace:

- Deal Value: $988 billion, up 13.4% YoY, just shy of Q1 levels.

- Deal Count: 12,605 transactions, up 18.6% YoY and 3.4% QoQ.

Despite persistent market uncertainty, Q2 was marked by cross-border consolidation, sector diversification and buyers and sellers aligning more smoothly on valuations – signs of a healthy, forward-looking M&A market.

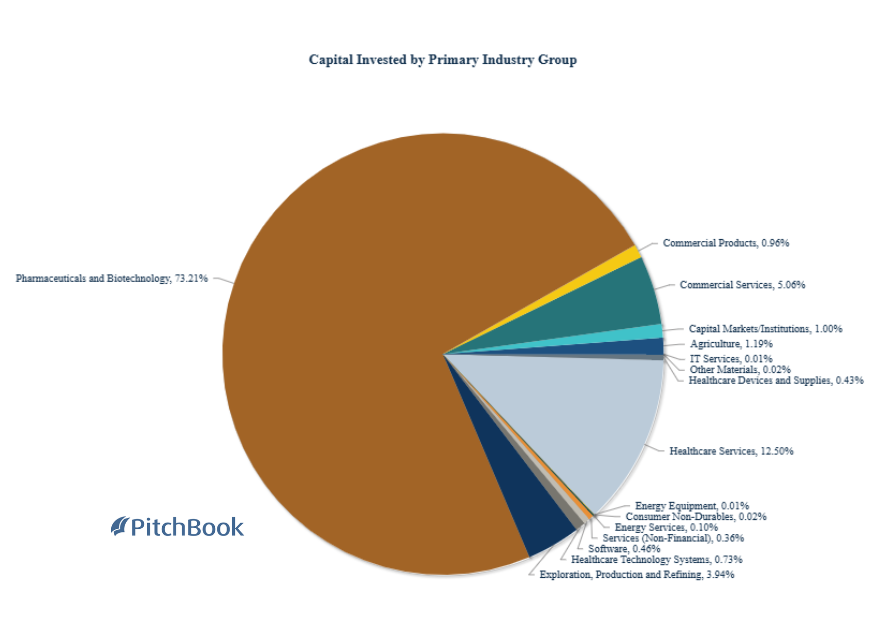

Sector Leaders – Impact-Focused

Q2 2025 was defined by high value plays in healthcare and life sciences, where capital poured into groundbreaking therapies and critical services:

- Pharmaceuticals & Biotechnology: $15.4B across 53 deals, driven by innovation in rare disease and oncology treatments.

- Healthcare Services: $2.6B across 25 deals, reflecting growing demand for clinical and hospital care providers.

The next two biggest sectors were:

- Commercial Services: $1.1B across 42 deals, proving steady appetite for scalable, service-driven businesses.

- Exploration, Production & Refining: $831M across 11 deals, fuelled by fewer but larger energy transactions.

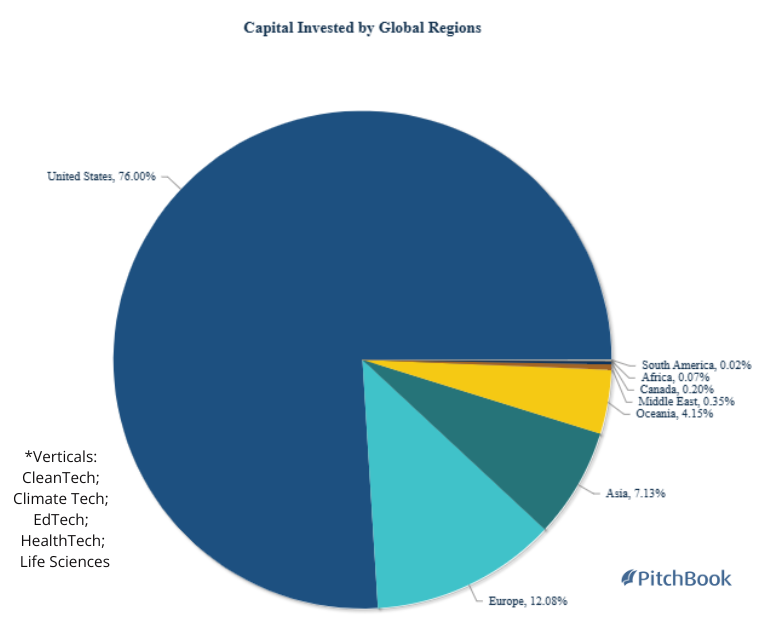

Q2 2025 Geographic Trends – Impact-Focused

- United States: 119 deals worth $16.0B, leading the pack in both volume and value.

- Europe: 103 deals totalling $2.5B, skewed toward mid-market activity.

- Asia: 41 deals, $1.5B, reflecting strategic, high-value investments.

- Oceania (inc. Australia and New Zealand): 14 deals, $875M, notable for high capital per deal.

- Canada: 15 deals, $41.8M, concentrated in smaller ticket sizes.

The clear picture: the US dominates by scale as usual, Europe maintains strong activity, while Asia and Oceania attract larger deal values per transaction.

Top 5 Global Impact-Focused M&A Deals (Q2 2025)

- Sanofi acquired Blueprint Medicines (US biopharma) for $9.5B – oncology & rare diseases.

- Merck acquired SpringWorks Therapeutics (US biopharma) for $3.41B – rare disease & cancer.

- McKesson acquired Florida Cancer Specialists (US healthcare) for $2.49B –oncology services.

- Novartis acquired Regulus Therapeutics (US biotech) for $1.7B – microRNA therapies.

- Grandblue acquired Yuefeng Environmental (HK) for $1.42B – waste-to-energy & sanitation.

Top 5 UK Impact-Focused M&A Deals (Q2 2025)

- ATAI Life Sciences acquired Beckley Psytech (Oxford biotech) for $390M – psychedelic therapies.

- K Bro Linen acquired Star Mayan (commercial laundry) for $142M – healthcare and hospitality laundry solutions.

- Alembic acquired UTILITY Therapeutics (Altrincham biotech) for $12M – antibiotic development.

- Nicoya acquired Applied Photophysics (Surrey) – Undisclosed – biopharma research tools.

- loveelectric acquired Bypass (UK) – Undisclosed – EV fleet management platform.

Earth Capital View: Navigating the Next Wave of Sustainable M&A

The first half of 2025 has been a turning point for global M&A. While the big numbers grab attention, what really stands out is the shift towards deals that create long-term value through innovation, sustainability and resilience. Healthcare and biotech are leading the way today, but we believe the next big opportunities will come from three areas:

- Decarbonisation and Clean Energy: Activity in renewables, energy storage and clean transport is gathering pace as businesses respond to the twin challenges of reaching net zero and securing reliable energy.

- Circular Economy Solutions: From waste-to-energy projects to resource efficiency, we’re seeing growing interest in companies that can turn environmental challenges into profitable, scalable businesses.

- Impact-Led Consolidation: With regulation tightening and customer expectations rising, businesses with strong sustainability credentials are increasingly attractive to buyers.

While scale and capital flows are important, impact will set the leaders apart. The investors and companies who back solutions that deliver both solid returns and measurable sustainability outcomes will be the ones best positioned to succeed in the years ahead.

Data Source: Pitchbook