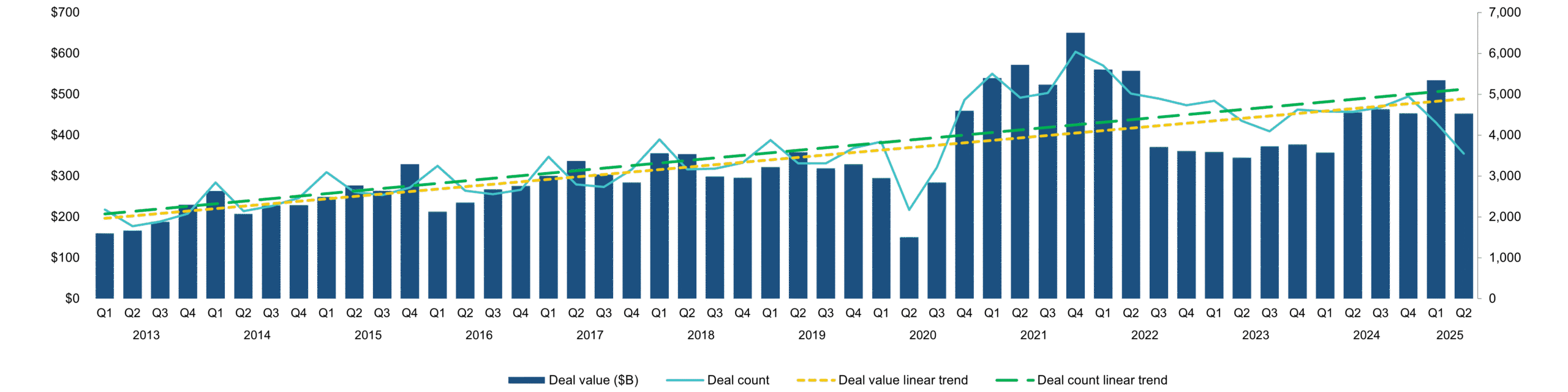

Q2 2025 Snapshot

- $383.3bn across 3,545 deals globally

- Down from $496bn in Q1, but strong vs. pre-pandemic levels

- 5th consecutive quarter with 3,500+ transactions

- Focus on middle-market and impact-driven sectors

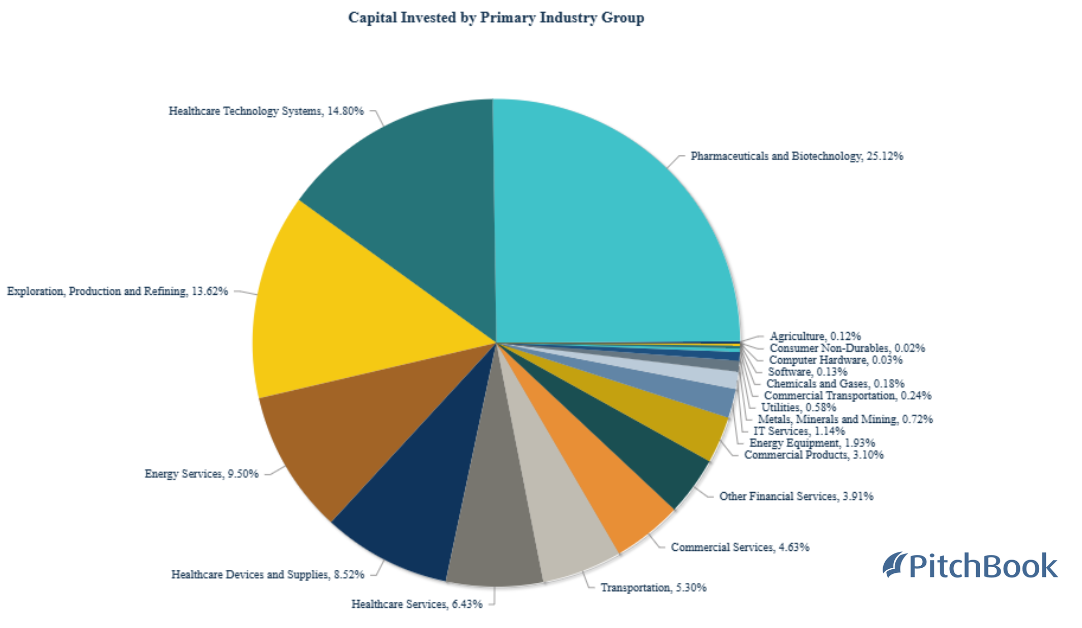

Sector Highlights – Impact Focus

- Pharmaceuticals & Biotechnology saw the highest activity with 62 deals and £4.2bn invested, reinforcing its status as the most attractive sector.

- Healthcare Technology Systems followed with 28 deals and £2.48bn, reflecting investor focus on digital health innovation.

- Energy-related sectors—Energy Equipment, Energy Services and Exploration & Refining—each reported 15 deals, drawing a combined £4.2bn in capital.

- Software (26 deals), Healthcare Devices & Supplies (20) and Healthcare Services (18) also remained active, contributing to a strong healthcare and tech showing overall.

- Key Takeaway

Healthcare and energy sectors continue to dominate both in volume and capital invested, while digital health and life sciences remain leading themes. Investor appetite is strongest where innovation meets infrastructure and impact.

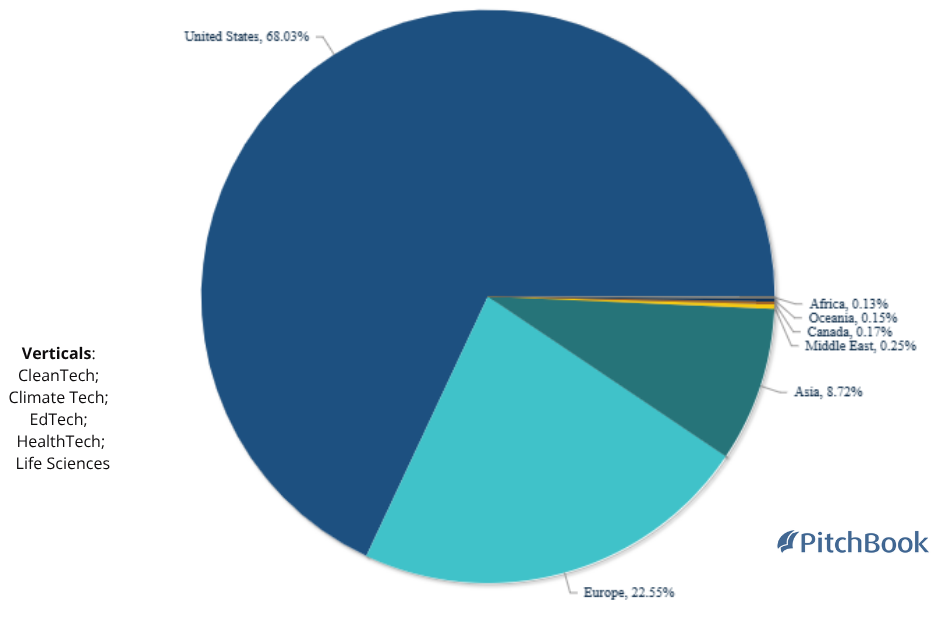

Geographic Trends – Impact Focus

- United States led with a massive $11.09bn, underlining its role as the global hub for PE activity.

- Europe followed with $3.68bn, maintaining strong interest across the continent despite regional headwinds.

- Asia attracted $1.42bn, a sign of steady momentum and emerging opportunity across healthcare, manufacturing, and climate innovation.

- Middle East ($41.4m), Canada ($26.9m), Oceania (inc. Australia and New Zealand) ($24.1m) and Africa ($20.7m) saw more modest investment, with activity largely concentrated in select niche opportunities.

Takeaway: While capital remains focused in traditional strongholds, Asia’s gradual rise reflects the beginning of a more diversified global private equity landscape.

Top 5 Global Impact-Focused PE Deals

Here are five standout global deals that reflect the sector’s evolving focus on sustainability, healthcare and long-term value creation:

- Goldman Sachs Asset Management acquired Synthon (Netherlands), a generic and hybrid pharmaceuticals leader, for €2.1bn, backed by €900m in debt financing.

- The Rise Climate Infrastructure Fund took Altus Power (U.S.) private for $2.2bn, accelerating the transition to renewable energy via solar asset management.

- Brookfield Asset Management acquired Geronimo Power (U.S.) for $1.74bn, supporting carbon-reducing renewable energy projects.

- Blackstone acquired VaxCare (U.S.) for $1.7bn, enhancing digital infrastructure for vaccination logistics.

- PharmaCord, backed by Permira, acquired Mercalis (U.S.) for $1.43bn, strengthening patient access and commercialisation solutions for life sciences companies.

Top 5 UK Impact-Focused PE Deals

The UK saw a number of impactful, strategically aligned transactions, particularly in cleantech, healthtech and biotech:

- Renewi, a London-based waste-to-product leader, was acquired by Macquarie Asset Management and BCI for $939.6m via a public-to-private buyout.

- OrganOx, an Oxford-based developer of organ preservation and transplantation devices, raised $160m in a growth equity round led by Avidity Partners, Soleus Capital, Sofina, HealthQuest Capital and Lauxera Capital Partners. The May 2025 deal brings its total funding to $255.7m.

- William Blythe, a 19th-century chemical manufacturer from Accrington, was acquired for $38.01m by H2 Equity Partners and management via an MBO from Synthomer.

- Bio Capital, a Buntingford-based operator of anaerobic digestion plants converting organic waste into renewable energy, was acquired by Equitix via a leveraged buyout (LBO) in April 2025 for an undisclosed amount.

- AMP Solar UK, a London-based provider of rooftop and ground-mounted solar systems for housing and commercial sectors, was acquired by The Carlyle Group in May 2025 via a corporate divestiture for an undisclosed sum.

Looking Ahead

Despite ongoing uncertainty around global tariffs and geopolitical tensions, PE deal-making remains strong, exceeding pre-COVID levels.

- 📈 Q2 2025 showed private equity’s resilience, with agile, growth-focused activity continuing across sectors.

- 🌱 The sector is becoming increasingly impact-driven, with sustained interest in healthcare, climate solutions, and ESG-aligned strategies.

- 🌐 Regional momentum was led by the U.S. and Europe, reflecting broad investor confidence.

- 🔮 With a strong Q2 performance, private equity is well-positioned for continued momentum into H2 2025.